SIHC continuously consolidates the leadership of its affiliated financial firms and strongly supports the development of other financial firms through strategic planning, business synergy, industrial integration and capital operation. The financial firms, such as Guosen Securities Co., Ltd., Guoren Property and Casualty Insurance Co., Ltd., Shenzhen HTI Group Co., Ltd., Shenzhen Small & Medium Enterprises Credit Financing Guarantee Group Co., Ltd., Shenzhen Investment Holdings Capital Co., Ltd., Shenzhen Toposcend Capital Co., Ltd., and Shenzhen Angel Fund Management Co., Ltd. etc., keep their leading position in the domestic market in terms of capital and business size, financial performance, and branding.

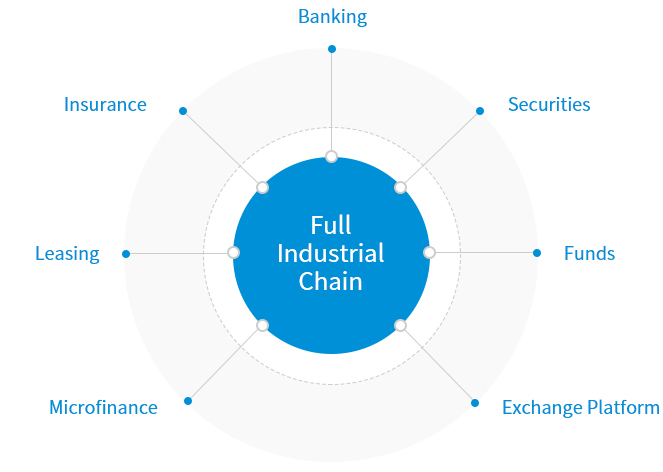

SIHC’s financial service ecosystem covers technology banking, technology securities, technology insurance, technology bonding, technology investment, technology leasing, technology AMC and etc., supporting technological innovation and industrial innovation, and providing comprehensive financial services for companies’ full life cycle development.

The Company strives to foster Guosen Securities, Shenzhen High-tech Investment Group, Shenzhen Small & Medium Enterprises Credit Financing Guarantee Group,TopoScend Capital and Guoren P&C into industry-leading enterprises. In addition, SIHC is focusing on acquiring banking & insurance licenses through mixed financial holding model of “science and technology park + comprehensive finance + industrial investment” to gradually build an all-dimensional and multi-functional financial services system

By the end of the “13th Five-Year Plan”, SHIC strives to build up a domestic leading technology financial holding group, and create an industrial cluster of financial services featured by fintech, to provide better allaround financial services to high tech corporate entities through financial supply-side reform.

To practically and effectively advance the integration of industry and finance, better serve and promote the development and operations of the parks and the investment and development of the technology sector, the Company plans to build a group of technology investment funds with over RMB100bn AUM (including a science and technology park construction fund and a technology investment fund) during the 13th Five-Year Plan.

Setting up a SIHC fund group represents an important step in serving Shenzhen’s overall strategy of “building an innovative city”, Shenzhen SOE’s development strategy of “establishing a large state-owned asset system” and “going global”, as well as SIHC’s development objective of “focusing on technology and industrial innovation and establishing 3 industry clusters”.

As of the end of July 2018, there are 27 funds under the SIHC umbrella, with a total size of RMB45bn, investing RMB8bn in 304 projects accumulatively.

GUOSEN SECURITIES CO., LTD.(www.guosen.com.cn)

PENGHUA FUND MANAGEMENT CO., LTD.(www.phfund.com.cn)

GUOREN PROPERTY AND CASUALTY INSURANCE CO., LTD.(www.guorenpcic.com)

SHENZHEN HTI GROUP CO., LTD.(www.szhti.com.cn)

SHENZHEN SMALL & MEDIUM ENTERPRISES CREDIT FINANCING GUARANTEE GROUP CO., LTD.(www.szcgc.com)

SHENZHEN INVESTMENT HOLDINGS CAPITAL CO., LTD.

SHENZHEN TOPOSCEND CAPITAL CO., LTD.(www.toposcend.com)

SHENZHEN ANGEL FOF MANAGEMENT CO., LTD.(www.tsfof.com)

PING AN INSURANCE (GROUP) COMPANY OF CHINA, LTD.(www.pingan.com)

CHINA MERCHANTS LIFE INSURANCE CO., LTD.(www.cmrh.com)

GUOTAI JUNAN SECURITIES CO., LTD.(www.gtja.com)

GUOTAI JUNAN INVESTMENT MANAGEMENT CO., LTD.(www.gimcs.com)

CHINA MERCHANTS LIFE INSURANCE CO., LTD.CHINA SOUTHERN ASSET MANAGEMENT CO., LTD.(www.nffund.com)

CHINA STATE-OWNED CAPITAL VENTURE CAPITAL FUND CO., LTD.

CHINA MERCHANTS PINGAN AMC(www.cmamc.net.cn)